Why ‘Time is Money’ is actually true

The Time Value of Money

Not every £ is the same. £1 today is worth more than £1 in the future.

We’ve talked about interest rates and the cost of money, but the cost of money has another side effect- it means that the longer you have to wait to receive money, the less it’s really worth to you.

This is called the time value of money, and it’s a very important concept.

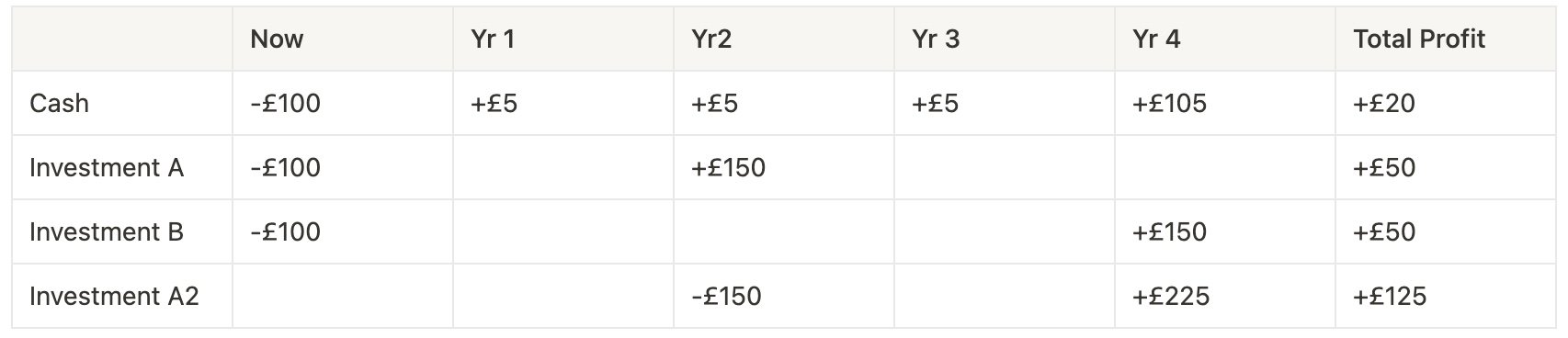

Suppose we have two identical investments that cost £100 that will each return us £150, so a 50% return. The only difference between them is that Investment A will return you £150 after two years, investment B will return £150 after four years.

What are each of these investments worth to us? Neither is worth £150. And B is worth less than A, because it’s going to return your money later.

While not immediately intuitive, once you think it through it makes sense.

Investment B will keep your cash tied up for longer, meaning you can’t do anything else with it (which is called ‘opportunity cost’).

A will return you £150 2 years earlier, which means you might be able to invest that £150 in another A again (shown above as A2). If you can invest in another opportunity like A again (A2), your initial £150 will be £225 in four years, significantly ahead of the £150 you’d have if you invested in B.

If you extend the holding period even further, then inflation also becomes a significant consideration. We all know that £1,000 today will buy you a lot less than it did 20 years ago, the same is likely true of £1,000 20 years from now.

So while two investments may offer exactly the same return to you in £ terms, if the time period involved is different, their real value will also be different.

What are those investments worth?

This all depends on your opportunity cost- what else could you invest in. The opportunity cost of investing in B over A is £75 over four years- because if you invest in B you’ll miss the opportunity of getting another £75 if you’d done A twice instead.

You also could of course just keep your investment in cash. Let’s say you can get 5% per year in cash:

On a simple basis, investment’s A&B give you a £30 better return that cash. Assuming cash is your zero risk option, then B will be worth at least £50, and A will be worth even more than that (because it returns your cash sooner).