UK Houses; a good investment?

Most people in the UK will tell you a house is an asset. Some finance gurus like Robert Kiyosaki will tell you it’s a liability.

Without doubt, those who’ve owned property in the UK over the last 20+yrs have done extremely well.

UK houses have been one of the best performing asset classes for most people in the UK. Anyone over the age of 50 has likely made far more in their house than any other investment they’ve ever made. Given the average holding period is around 20 years, most people will have seen their properties increase in value by between 3-8x (depending on where they live).

Add in the fact that property is an investment that most people lever up to purchase (ie they borrow money) and the cash on cash return for people is even greater.

House prices today stand at an average of 9x annual income. In 1970 they were on average 4x income. That significant real change in the price of homes has had a huge impact on society, the wealth dispersion across age groups and overall living standards in the UK.

Is a house a good investment today?

When considering buying a house to live in, there is a significant emotional element to consider- owning your own home brings a sense of peace and security which should not be ignored. It is not purely a financial decision.

However, for simplicity what follows here is a purely financial assessment of the risk/return of buying a home to live in. (Buying property to rent is a different calculation).

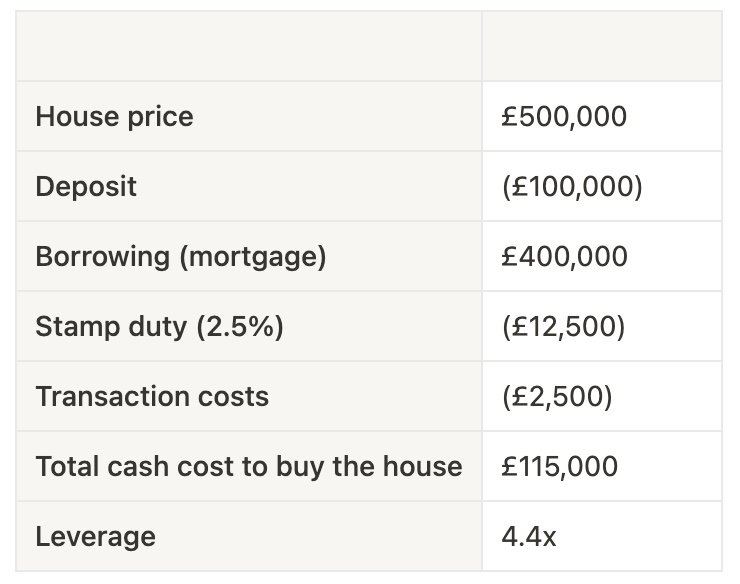

Let’s work through a simple example assuming a £500,000 house with a typical 20% deposit.

These are the approximate purchase costs:

I mentioned briefly above the leverage involved with home buying- you can see here that you’ve increased your buying power 4.4x by using a mortgage- that’s your leverage.

Side note: its an interesting societal quirk that we’re happy accepting huge amounts of leverage on houses- but if you approached someone and suggested they take out a loan of 4-5x their annual salary to invest in anything else (stocks, gold, savings, a business etc) they’d certainly tell you you’re crazy. When it comes to houses we see that debt level as absolutely fine, and indeed recommend it.

We’ll work through some scenarios to see what will happen if house prices go up or down after you buy that house.

Scenario 1: house prices rise 10%

If the price of your house rises 10%, this is your return (including 1.5% transaction costs to sell, which you’d need to pay to actually get this return).

Note- all of these calculations ignore the impact of mortgage paydown (you paying your mortgage every month) for two main reasons:

1. it makes a tiny difference over any time period of less than 10 years,

2. paying down the mortgage uses your own money, so it’s not an investment return.

The 10% price increase has created a 23% return (thanks to your 4x leverage). That is brilliant. But, if you sell your house you need to buy another one to live in.

Assuming you aim for the same value and don’t trade up or down, you will need to sell your current house, buy a new one, plus physically move. The total transaction costs involved in moving house are pretty significant:

Transaction costs are around 7-8% of the total value of the property. Many people won’t think of the stamp duty they paid for house 1- but that’s real cash that you can’t get back so it’s a legitimate part of the overall transaction costs that needs to be considered.

This is what it would look like to move to house 2:

Counting in the real costs if you want to move your actual return on a 10% price rise is now a 7% profit. Seems fine, but you can see that the transaction costs have eaten some of your profit.

Scenario 2: prices stay flat

Let’s assume you’ve been in your house for a while, the price hasn’t moved at all but you need/want to move.

This is what it looks like for you:

Flat house prices will leave you £24,250 short of being able to move to an equivalent house- you’ll lose £23,250 of the £115,000 you originally put into the first house.

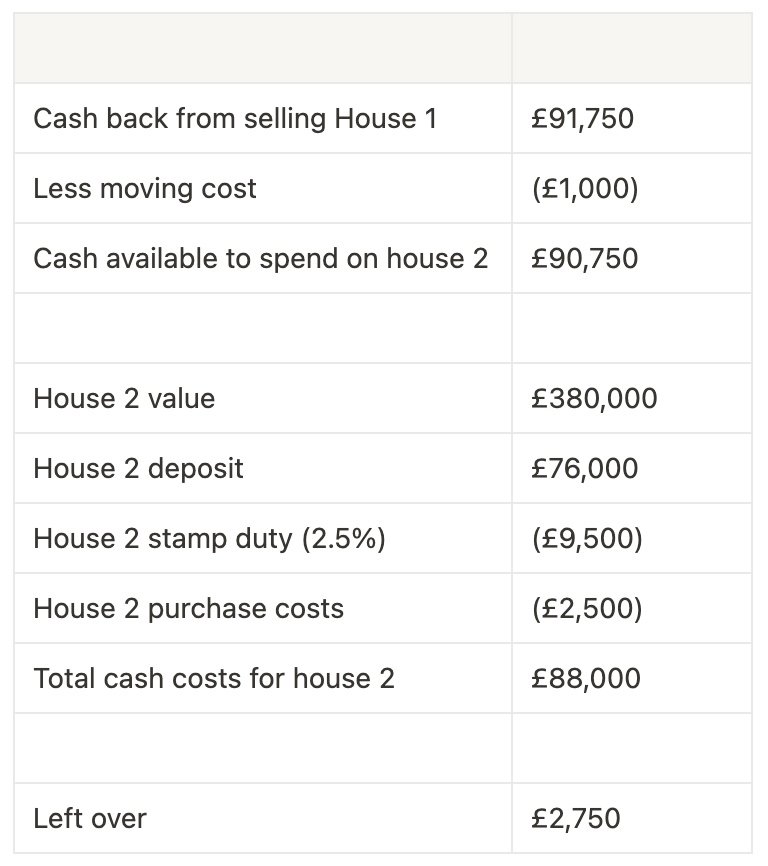

You’ve now only got £91,750 to put into buying a house, quite a bit less than your first purchase. So you’ll now only be able to afford a cheaper house- this means your buying power has been eroded. But by how much?

Unfortunately, it’s a lot. Flat house prices will erode your real buying power by around 24%. You will now only be able to a afford a house priced around £380,000:

If the value of your house doesn’t go up, you will lose almost a quarter of your buying power.

And what if things got worse and prices actually fall?

Scenario 3: prices fall 10%

Rather than flat prices, if instead prices fall you’re going to be in real trouble.

This is where leverage hurts- it’s great on the upside and really painful on the down.

You’ve just lost £73,250 of your original £115,000 investment for just a 10% price fall.

But that’s not even the nasty part… the real problems come when you try to buy another house.

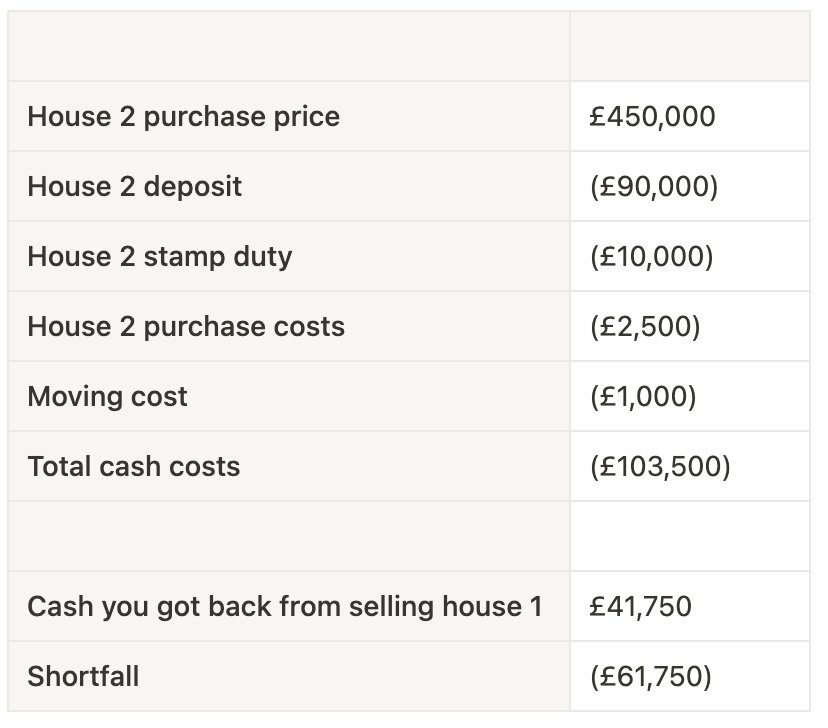

For an equivalent house you’re going to need a deposit of £90,000 (lower than before as prices are down 10%), plus the usual stamp duty and solicitors and moving fees.

Your total cash requirement is £103,500 (down from the £115,000 you needed first time round):

You’re now £61,750 short of being able to buy an equivalently priced house somewhere else.

If you don’t have an extra £61,750 to put into a new house, you’re going to have to downgrade. Using the same 20% deposit requirement your £41,750 you’d get back from selling House 1 would now buy you another house priced at only £208,750.

Just a 10% decline in the price of your house more than halves your buying power.

Return vs Risk Summary

Here are the summarised returns from the above scenarios starting with a £500,000 house:

Buying a house is not an even bet- your downside is more than double your potential upside.

This is what happens when you apply huge leverage to an asset with high transaction costs.

What does all this mean?

It means you need house prices to keep going up. They can’t fall or even just stay flat.

If you think house prices will continue to rise, then you should buy one as you get levered upside return. You’ll have greater buying power and be able to move to a nicer house in a few years time as your buying power will increase faster than the house prices.

But unless the price of your house goes up, you stand to lose a lot of money.

If house prices stay flat, you’ll lose almost a quarter of your buying power.

If house prices fall 10%, you’ll lose more than half of your buying power.

If either of the above happens, you have three options:

stay in the house and hope the price goes up

stay in the house and wait until you’ve either saved sufficient additional cash to maintain your buying power or paid that much off your mortgage (likely 10+ years)

downgrade to a less expensive house

In reality most people will choose 1 or 2. They will be forced to stay and not be able to move.

If you’re worried that prices may fall or even just stay flat, you need to very carefully consider the financial risk you’re taking on when buying a house, and expect that you may be forced to stay there for at least 10 years.

Should you consider renting instead for a while?

Despite the societal negativity and social pressures against renting, it can work out as more cost effective depending on your situation.

To understand which is best for you, use our free Buy vs Rent Calculator- click here.